By Dee Dee Sung

Under water

Q. I need advice on my credit card debt. Currently I have eight cards, most of them maxed out. I believe the total owing is just under $16,000. Even though my credit is good, I find myself living paycheck to paycheck just to keep making the minimum payments on time. What's frustrating me is that the balances on these cards don't seem to be coming down and I feel stuck in a rut. I'm looking for some guidance on how to change this situation.

A. In past columns, I've addressed three distinct debt relief options that exist for consumers – debt settlement, debt management and bankruptcy. These options apply to when one must make a drastic change as no other options seem to exist. It sounds to me that none of the above options would apply as you're in a situation where you're clearly able to maintain your payments in a timely manner with no undue stress but are feeling like there's no light at the end of the proverbial credit card debt tunnel. I've been in this situation myself and do agree that it's extremely frustrating to not see the balances go down and wonder how they got up there to start with. To help, I have created The Debt Free Diva's 5 C's of debt reduction. Not only must you have a plan on how to eliminate your credit card debt, you must also understand what causes you to stay in credit card debt. This system deals both with the practical as well as the emotional sides of getting out of debt. Here are the 5 components:

CHECK your credit report for accuracy. This should be done at least twice a year and you can do so by going to www.annualcreditreport.com. The reports are free of charge although you will have to pay to obtain your credit scores.

CUT your credit card interest rates. This can be done either by asking the creditor to lower your interest rate or by transferring your balances to cards with lower rates. When you negotiate a lower rate with the credit card company, know beforehand what your current interest rate is, how long you've had the card, how much you've charged during that time and what you'd like to have that rate lowered to. Many people think it's impossible to request a lower rate. Remember, if you don't ask, you won't know!

CLARIFY what got you into credit card debt to begin with. Are you an unconscious spender? Are there particular situations that trigger you to spend? Getting clear on where you're currently at and where you want to go financially will play a significant part in getting yourself out of debt.

CREATE a step-by-step plan that incorporates your financial goals and objectives. Your plan will include eliminating your debt, building a reserve fund, saving for your future and, of course, creating a realistic spending plan that will allow you to achieve all that as well as enjoy the present. If debt elimination is your first goal, write down everything you owe, determine how much money you can free up (if you think you have no extra cash to free up, you'll be amazed at where your money's going once you start tracking your spending), and embark on a payoff plan where you focus on paying down the smallest balance first, and when that debt is paid off, applying those funds to the next lowest balance. Keep on this track until your credit card debt is paid off. This is a common and highly effective method for debt elimination. This will call for making some sacrifices but it's important to understand that at all times, we are at choice. Knowing this allows us to make wiser decisions with our money.

COMMIT to creating a financial plan that will support you in living a life in balance. Tending to both your current and future needs is of equal importance. In addition to commitment, this will call for you to be patient, disciplined and willing to make the necessary changes that will create financial freedom for you.

By following these 5 steps, I'm confident your frustration with credit card debt and living paycheck to paycheck will soon turn to optimism and excitement!

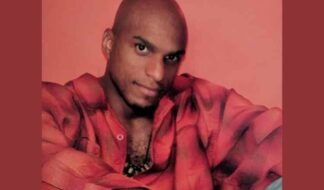

Metro Detroit speaker, author and syndicated radio personality Dee Dee Sung is the founder and creative director of The Debt Free Diva with a mission to educate, entertain and inspire people in reinventing their relationship to money.