The Biden administration signaled on Tuesday anti-LGBTQ+ discrimination among lenders of credit is illegal, marking the latest policy move to bring the U.S. government into compliance with the U.S. Supreme Court ruling in Bostock v. Clayton County.

The Consumer Financial Protection Bureau announced the prohibition on sex discrimination under the Equal Protection Credit Opportunity Act and Regulation B prohibits lenders from discrimination on the basis of sexual orientation or gender identity with a proposed regulation, which will become final after publication in the Federal Register and a comment period.

"In issuing this interpretive rule, we're making it clear that lenders cannot discriminate based on sexual orientation or gender identity," CFPB Acting Director David Uejio said in a statement. "The CFPB will ensure that consumers are protected against such discrimination and provided equal opportunities in credit."

CFPB's proposed rule is consistent with the reasoning behind the Supreme Court's decision last year in Bostock v. Clayton, which found anti-LGBTQ+ discrimination is a form of sex discrimination, thus illegal under the ban on sex discrimination under Title VII of the Civil Rights Act of 1964. The ruling has broad applications to all laws against discrimination on the basis of sex, including federal bans on discrimination in housing, credit, education, and jury service.

Michael Adams, CEO of the LGBTQ+ elder group SAGE, said in a statement the announcement from CFPB "lifts a burden for LGBT older people who, for much of their lives, have felt compelled to hide their sexual orientation and/or gender identity when seeking access to credit."

"SAGE applauds the announcement by Acting Director Uejio and the Biden administration, confirming the vital legal protections LGBT elders – and all LGBT people – deserve regarding something as essential as access to credit," Adams said.

According to SAGE, LGBTQ+ older people – particularly transgender and LGBTQ+ elders who are people of color – face disproportionately higher poverty rates than their straight and cisgender counterparts, which makes access to credit "all the more critical." Under the new regulation, a loan officer at a bank or an agent taking a credit card application over the phone is prohibited from denying people credit for being LGBTQ as opposed to their financial qualifications.

In 2016, the CFPB previously signaled during the Obama administration in response to an inquiry from SAGE the Equal Protection Credit Opportunity Act affords protections to LGBTQ+ people. The new proposed regulation, however, offers more formality to that interpretation of the law.

Karen Loewy, senior counsel and seniors strategist at Lambda Legal, also hailed the regulation as a follow-up to the initial announcement, saying "this explicit interpretive rule renews and formalizes that commitment."

"We know that credit discrimination is a huge barrier to financial security for LGBTQ+ people, depriving people of financing for homes, cars, school or small businesses," Loewy said in a statement. "Studies show that same-sex couples routinely have been denied opportunities and faced less favorable terms than different-sex couples in seeking mortgages. LGBTQ+ people regularly report being denied lines of credit because of their sexual orientation or gender identity or expression."

According to the proposed rule, at least 20 states and D.C. have prohibited discrimination on the basis of sexual orientation and gender identity in certain or all credit transactions. As such, financial institutions subject to such laws were required to comply with those requirements prior to the issuance of the Bostock opinion.

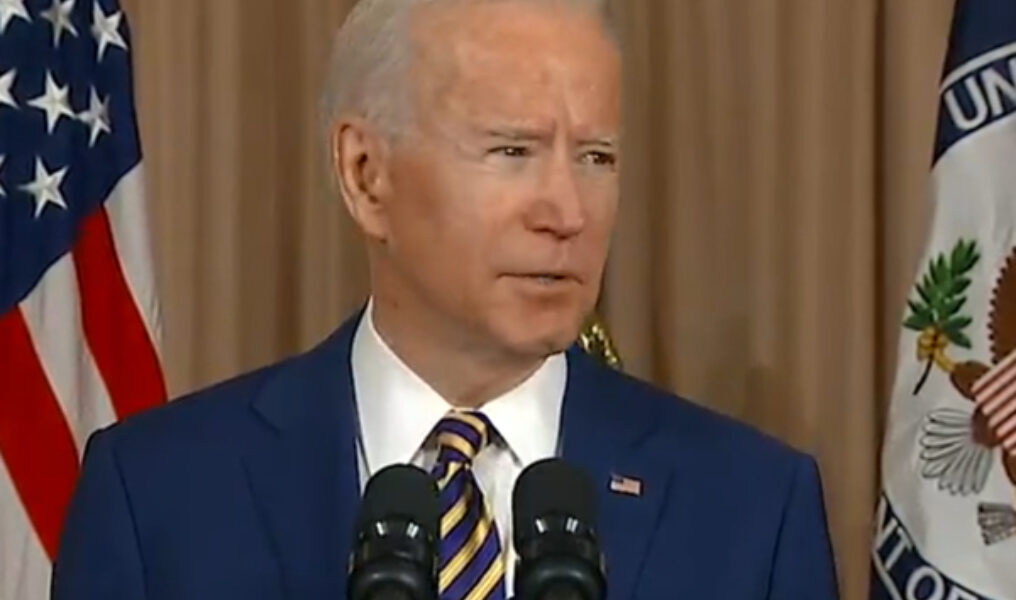

CFPB's announcement is consistent with the executive order President Biden signed on his first day in office ordering U.S. agencies across the board to implement the Bostock decision. Last month, the Department of Housing & Urban Development announced it would begin accepting complaints of anti-LGBTQ+ discrimination under the Fair Housing Act.

This article originally appeared in the Washington Blade and is made available in partnership with the National LGBT Media Association.