By Dee Dee Sung

Q. I've been hearing so much about identity theft. Although it hasn't happened to me, I'm concerned that I'm not aware of steps I can take to protect my identity. Could you share some steps that could help me?

A. We're facing an attack on our personal and financial privacy unlike ever before and given that it's virtually impossible to protect our personal information it's all the more reason why you need to know a few simple steps to reduce your risk of being jeopardized.

Identity theft is at epidemic levels and that's why you're hearing so much about it. Thieves are brash and steal information through such methods as sifting through trash and looking over people's shoulders to spot important account numbers. In fact, here's a frightening statistic: someone who's been a victim of identity theft can spend up to 600 hours – that's 25 days to resolve the situation. Unresolved it can lead to one nightmare of a credit rating.

Here are some simple ways to protect yourself:

- Safeguard your SSN – it's the #1 target for thieves as it gives them access to your credit report and bank accounts. In fact, it's advisable not to carry it on you.

- Always destroy records and statements that contain your private financial information. The best way is to shred these documents. However, if you don't have a shredder, make sure you tear or cut them up. To throw them away in one piece will put you in a vulnerable position for a would-be thief to snatch your information.

- Absolutely know who you're dealing with when asked to give out private identity or financial information – listen to your gut and if it doesn't feel right, don't give it out.

- Be extremely guarded with your personal information – when at all possible, don't give out your SSN number and ask what alternate information can be given instead.

- Make sure mail doesn't sit in your mail box for long as thieves like to snatch credit card offers. If you know you're going to be away for a period of time, arrange to have someone collect your mail for you.

- Be sure not to leave a paper trail of ATM, credit card or gas station receipts behind and never, ever let your credit cards out of your sight.

- Take your name off of marketers' target lists by calling the "Do Not Call Registry" at 888-382-1222 or visiting https://www.donotcall.gov. This will stop the credit card solicitations as well as cut down on junk mail received.

- Monitor your credit report on a regular basis. Go to http://www.annualcreditreport.com to request a copy of your report. If you spot something suspicious, alert your card company or the creditor immediately. If you're an identity theft victim, request that a "fraud alert" be placed in your file along with a victim's statement asking that you be contacted before opening any new accounts or making changes to existing accounts.

- Review your credit card and bank statements regularly and carefully. If some transactions look suspicious, file a dispute immediately. Above all, keep records of absolutely every communication involved in your efforts to clear up the identity fraud.

I hope you never become a victim of identity theft and at least, you now know what steps to take to protect yourself!

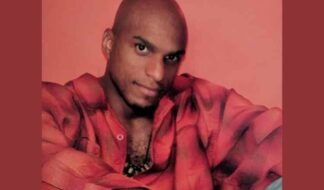

Metro Detroit speaker, author and syndicated radio personality Dee Dee Sung is the founder and creative director of The Debt Free Diva with a mission to educate, entertain and inspire people in reinventing their relationship to money. Be sure to listen to Magic 105.1 every Sunday at 7:30 a.m. for "The Debt Free Diva" talk show. To learn more, visit http://www.debtfreediva.com.